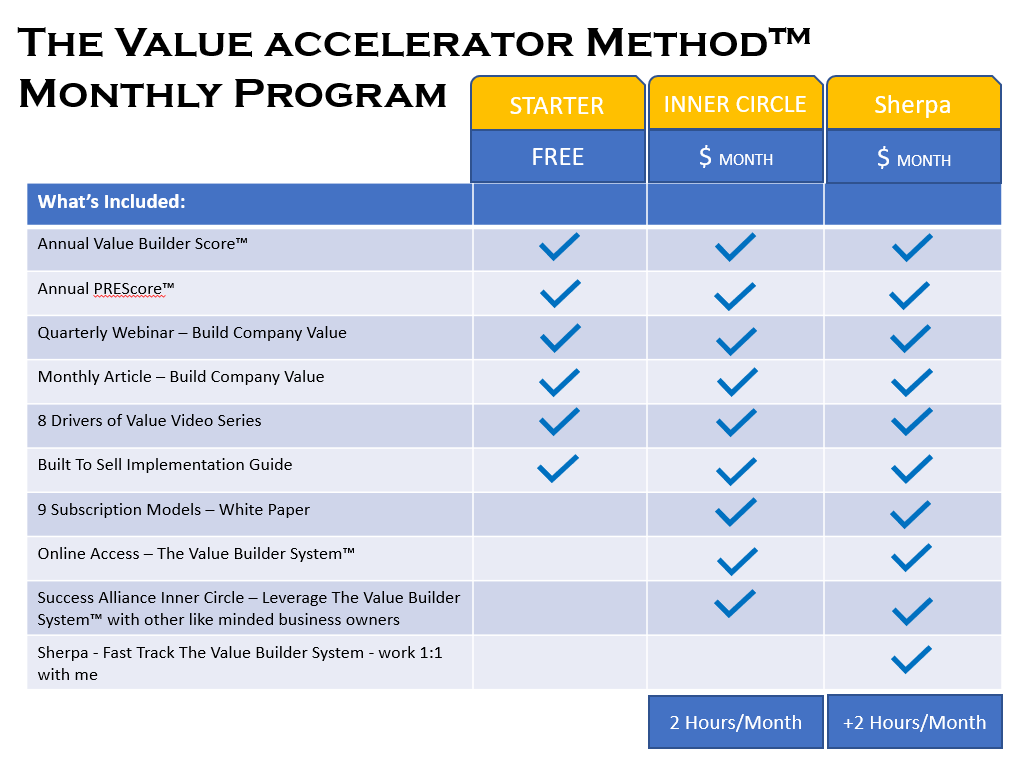

The Value Accelerator method™

The Statistically Proven

System To Increase Value

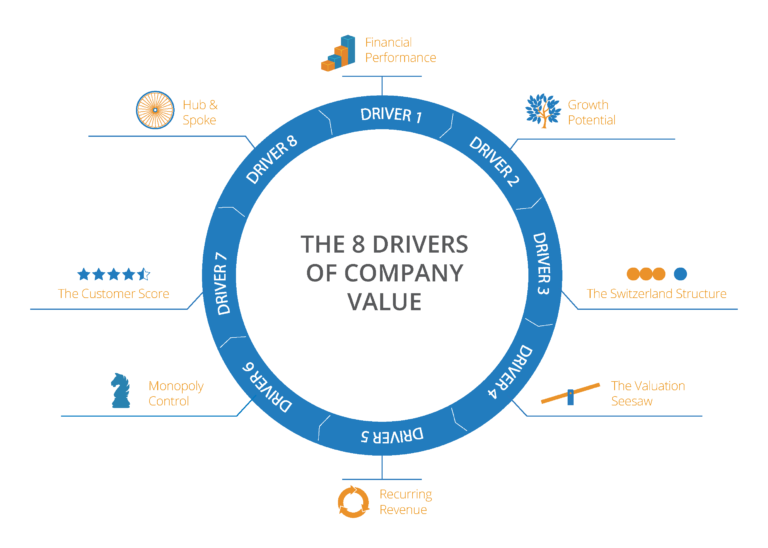

There are 8 key factors that drive the value of your business that can be improved individually or collectively.

Challenge your thinking and way of doing

Running your company day-to-day leaves little time to think strategically about your business and how to improve it. I will challenge you to think about answers to questions like:

- What could your business be worth?

- What would you need to change to make your business attractive to an acquirer

- What are the hidden assets that would make your business irresistible to a buyer?

- Are there any silent killers that could derail the sale?

I’ll help you get answers to these questions and much more…

8 Key Drivers Of Company Value

01.

Financial Performance

Your history of producing revenue and profit combined with the professionalism of your record keeping.

Easy to understand yet difficult to deliver.

What’s your top line revenue and what’s your bottom line profit.

There is a second “hidden” element. It’s not just about what those numbes are, but also the quality of the reporting of those numbers. You need to make sure your numbers are as defendable as possible.

02.

Growth Potential

Your likelihood to grow your business in the future and at what rate.

We all want our business to be valued on what we have done in the past. We are proud of our achievements – that’s normal!

The hard truth is that a buyer is not buying the past or what you have done.

They are only buying one thing: your future stream of profits. What will this business do in the future?

Focus on what is the future potental of your business and ways you could scale up the business.

03.

Switzerland Structure

How dependent your business is on any one employee, customer or supplier.

This “independence” is essential for building a “sellable” company.

Don’t have an overly concentrated customer set. Have good diversification.

Don’t be overy reliant on one employee.

Don’t be oberly dependent on one supplier.

For a buyer, if you are overly dependent on any one of these, that is a risk which will result in them discounting your valuation. It’s too risky for them.

04.

Valuation See-Saw

Whether your business is a cash suck or a cash spigot.

When a buyer comes along, they have to write two cheques. One to you as seller, and another that most people don’t think about.

The second cheque is to fund your companies working capital – the money your business neeeds tp operate when you hand over the keys.

The buyer has to write both cheques from the same cheque book. The more your company sucks up cash to operate, the less they will be willing to pay.

Work on ways to generate cash within the business.

05.

Recurring Revenue

The proportion and quality of automatic, annuity-based revenue you collect each month.

The buyer wants to know how this business will continue whenyou leave.

The more recurring revenue you have, the more valuable it will be.

There are 6 main types of recurring revenue nd each will impact value differently. Some create more value than others.

What types of recurring revenue can you implement and what proportion of overall revenue can they be. The higher, the better.

06.

Monoply Control

How well differentiated your business is from competitors in your industry.

You will have control over how you price your product – you are not being comoditized and have some uniqueness in the market.

Warren Buffet invests in companies that have “a deep and wide moat” around their business – a differentiated market positioning.

That gives ability to control pricing and increase margins.

Consider: does this make us different and do customers care?

07.

Customer Satisfaction

The likelihood that your customers will re-purchase and also refer you.

How satisfied your customers are will be important to a buyer.

When you are gone, how likely is it the business will continue to generate profit with existing customers.

Benchmark your performance on the likelihood customers will recommend you. It helps you know and buyers see that customers are satisfied and will repurchase from you.

08.

Hub & Spoke

How your business would perform if you were unexpectedly unable to work for a period of three months.

How dependent is your company on you personally? How will this business operate when you leave?

The more dependent your company is on you, the lower will be your valuation.

When everything is dependent on you, there is not much value left in the business.

Document systems and processes. Get it out your head, so the business can operate when you are not there. Train others.